Blind dog in the meat market

The Argentinian government has banned meat exports. It's a terrible idea.

The meat of the matter

Last week, the Argentinian government announced it would ban all meat exports from leaving the country for 30 days. The explicit aim of this measure is increasing the domestic supply of meat and thus lowering meat prices, which have increased 22% since the beginning of the year (vs 17% for the headline CPI).

The arguments for why this is wrong are twofold. Firstly, there is the moral argument: there simply isn’t any real reason to intervene. Meat isn’t all that important, and “people like meat” just doesn’t pass the smell test for justified meddling in markets. Meat being expensive isn’t some sort of intolerable depreivation, or a human rights violation, or a market failure. Secondly, there’s the economic argument: it will backfire.

Let’s start with the econ 101 model: there would first be too much domestic supply after the export ban, followed by a reduction in production and then a return to equilibrium, with a lower quantity bought and sold that matches the lower price. But this is the real world, with one key factor to consider: time. Cows take a long time to mature, so the market won’t really clear at the new price for a few years, because the vast majority of the cows that will be bought and sold at the new price haven’t been born yet.

The time component also points to the crux of the problem: the export ban will never last just 30 days or just a few months - it has to be prolonged indefinitely. It’s not really hard to see why: if a rancher doesn’t want to sell at the lower prices, they just have to wait 30 days until the ban expires, and only then turn their cows into meat. Unless the measure is permanent, this will continuously happen at the margin: suppliers have a product that can stick around in their fields until they can sell at higher prices.

It’s also worth pointing out that meat makes up just 8% of total exports and the same proportion of all products in the CPI, so it wouldn’t have a significant anti-inflationary component regardless. Another point in its favor that has been brought to my attention on Twitter is that this move would increase international meat prices (Argentina is the world’s 4th largest producer, making up 8% of the market), which would in turn benefit domestic producers - but the government wants prices to go up, not down, and domestic producers wouldn’t be benefitted anyways because the whole point is that no meat will leave the country.

Regardless, this exact measure has been tried… in 2006, and lasted until 2015. Let’s take a look at what happened.

Fat cows and thin cows

The key measure to look at here is the relative price of meat, i.e. the price of meat versus the normal CPI. The reason why we’re focusing on this measurement is that we want to figure out if, compared to “normal” products, the price of meat increased or decreased - and when.

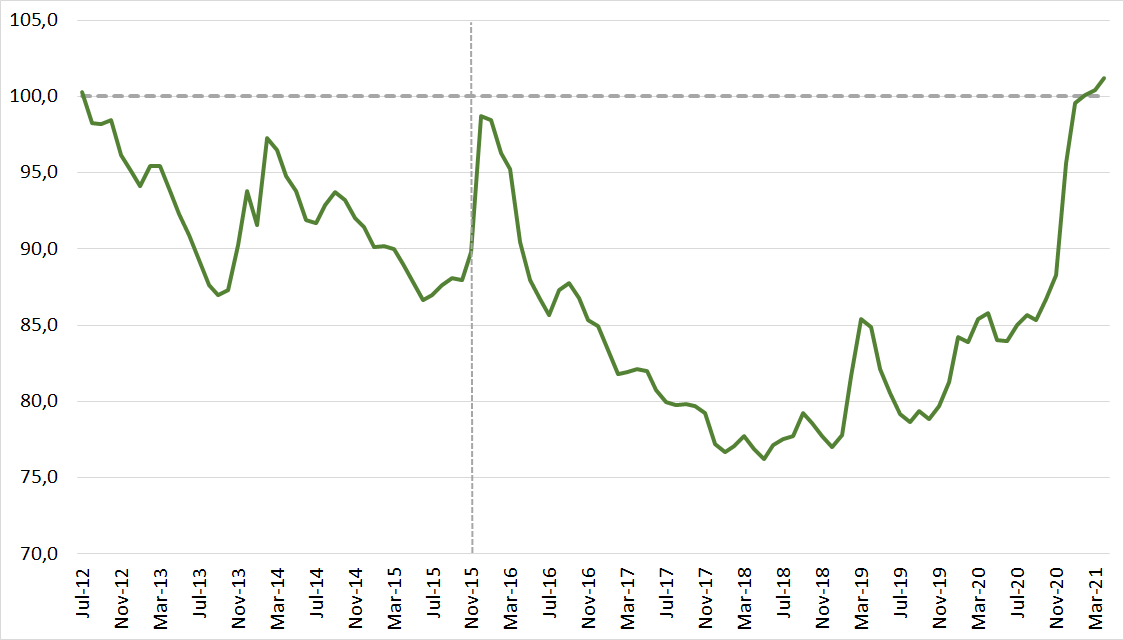

This is problematic because, between 2007 and 2016, inflation measurements were tampered with. To solve this, I used the prices of the ten most popular cuts and compared that to inflation - which is an imperfect proxy, but no jurisdiction has detailed enough data from 2006 to 2016. There is some jurisdictional data from 2012 to the present, plus national data from late 2016 to the present.

The original meat ban was imposed in March 2006, to prevent “abusive and speculatory practices” by the sector, and was supposed to last for 180 days. Instead it lasted for roughly 3500 days, until November 2015.

To start, there was indeed a short term drop in prices - they decreased in absolute terms by 10% between March and October of 2006, and 2006 had meat prices 10% lower than 2005. But by mid 2007 most of this effect had vanished, and throughout that year relative prices increased by 7%, thus erasing most of the “gains” for consumers. This dynamic only worsened in 2008 and 2009, where relative (and absolute) prices didn’t just revert to the pre-export ban levels, they exceeded them by roughly 20%.

Then came 2010, which started with a 24% hike to relative prices and then had an even bigger, 30% jump in just the first quarter, plus another 10% increase in October. By the end of the decade, average absolute prices were 2.4 times higher than in 2006, with most of that increase happening in just two years. There was another rapid increase in late 2013 and the first six months of 2014, but that’s neither here nor there. By November 2015, when the measure was finally lifted, prices were between nine and ten times more than they had been in March 2006.

Now, we cannot argue from a price change - it is, in fact, one of the cardinal sins of economics. If prices increase, that means demand outstrips supply, but we can’t know ex ante which part of the market caused it (if relative prices increase, it means the same but for specific vs general demand and supply).

Between 2006 and 2015, total meat production decreased by 10% (-310k tons), exports shrank 65%, and consumption just increased 2%. And if you look at the worst year of them all, 2011, then production dropped 18% (-540k tons) and consumption also decreased, by 9%. Experts in the sector estimate that about 100 meat processing plants dropped, costing the sector about 10 thousand jobs. (Note that exports didn’t decrease 100% because some parts of the market were still allowed to operate).

What has happened after 2015? Plenty. After the election of a more pro-market government in 2015, the export ban was lifted. We will use the City of Buenos Aires’s CPI, which includes a more comprehensive list of products, but also a different composition (considering the city is about three times wealthier than the rest of the country, in per capita terms).

Initially, prices readjusted significantly, with a relative price change of 10% in the first month after the measure. But then relative prices decreased rapidly, and by May 2018 they were a full 15% lower than in 2015. This occured right before the current recession started, resulting in a significant acceleration of inflation. In fact, meat prices increased rapidly in 2018 and 2019… returning to 2016 levels and still 21% below 2012 levels. Relative prices have (somewhat inexplicably) increased significantly in the past 4 months, by about 11%. As previously stated, there isn’t a strong moral case to do anything here.

Conclusion

In the end, it’s clear from history that export bans on meat will not work in any period longer than this year. While there has been an increase in prices since 2018, coupled with a drop in consumption and an increase in production, it’s not clear why the government should do anything about this situation - and it’s especially clear that, if the government did anything, what it shouldn’t do is ban exports.

Additionally, while I said there wasn’t an inflationary component to the measure, this wasn’t precisely accurate. Most economists, on the left and the right, argue that a shortage of US dollars could worsen the inflationary situation (which, let’s keep in mind, has lingered at 60% annualized for the past 4 months).

And finally, this seems just bizarre considering that clothing and footwear prices (which, some would say, are actually more important than meat) have increased just as much in the past 6 months, and have the exact same incidence in the CPI. Considering we only export a million dollars of textiles a month, and that it is one of the most protected sectors in the economy, the government should be applying the same pro consumer zeal and allowing textile imports to reduce clothing inflation, right? Think again.